Multiple Choice

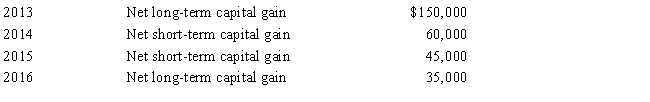

Carrot Corporation,a C corporation,has a net short-term capital gain of $65,000 and a net long-term capital loss of $250,000 during 2017.Carrot Corporation had taxable income from other sources of $720,000.Prior years' transactions included the following:

Compute the amount of Carrot's capital loss carryover to 2018.

A) $0

B) $32,000

C) $45,000

D) $185,000

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q6: The passive loss rules apply to closely

Q20: An expense that is deducted in computing

Q63: In the current year, Plum Corporation, a

Q68: A corporation must file a Federal income

Q77: Which of the following statements is incorrect

Q78: During the current year,Quartz Corporation (a calendar

Q79: Grebe Corporation, a closely held corporation that

Q85: On December 31,2017,Peregrine Corporation,an accrual method,calendar year

Q86: Canary Corporation,an accrual method C corporation,uses the

Q110: Schedule M-2 is used to reconcile unappropriated