Essay

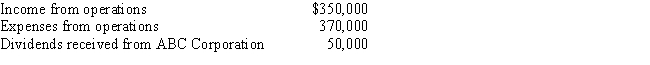

During the current year,Quartz Corporation (a calendar year C corporation) has the following transactions:

Quartz owns 25% of ABC Corporation's stock.How much is Quartz Corporation's taxable income (loss) for the year?

Correct Answer:

Verified

Quartz has an NOL,computed as ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q6: The passive loss rules apply to closely

Q20: An expense that is deducted in computing

Q75: Ivory Corporation,a calendar year,accrual method C corporation,has

Q76: For a corporation,the domestic production activities deduction

Q77: Which of the following statements is incorrect

Q79: No dividends received deduction is allowed unless

Q79: Grebe Corporation, a closely held corporation that

Q82: Carrot Corporation,a C corporation,has a net short-term

Q110: Schedule M-2 is used to reconcile unappropriated

Q115: Albatross, a C corporation, had $140,000 net