Multiple Choice

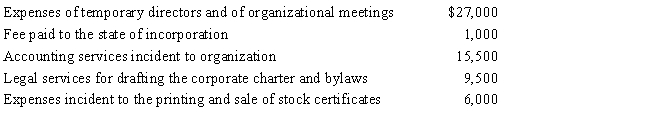

Emerald Corporation,a calendar year C corporation,was formed and began operations on April 1,2017.The following expenses were incurred during the first tax year (April 1 through December 31,2017) of operations.

Assuming a § 248 election,what is the Emerald's deduction for organizational expenditures for 2017?

A) $0

B) $4,550

C) $5,000

D) $7,400

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q18: Under the check-the-box Regulations, a two-owner LLC

Q25: For purposes of the estimated tax payment

Q61: In connection with the deduction for startup

Q92: Eagle Corporation owns stock in Hawk Corporation

Q95: Amber Company has $100,000 in net income

Q98: Copper Corporation owns stock in Bronze Corporation

Q99: Heron Corporation,a calendar year,accrual basis taxpayer,provides the

Q100: Heron Corporation,a calendar year C corporation,had an

Q101: Schedule M-1 of Form 1120 is used

Q130: In the current year, Crow Corporation, a