Heron Corporation,a Calendar Year,accrual Basis Taxpayer,provides the Following Information for the Current

Essay

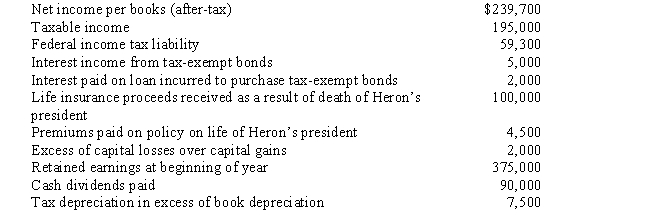

Heron Corporation,a calendar year,accrual basis taxpayer,provides the following information for the current year and asks you to prepare Schedule M-1.

Correct Answer:

Verified

Net income per books...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q7: Lilac Corporation incurred $4,700 of legal and

Q25: For purposes of the estimated tax payment

Q61: In connection with the deduction for startup

Q95: Amber Company has $100,000 in net income

Q97: Emerald Corporation,a calendar year C corporation,was formed

Q98: Copper Corporation owns stock in Bronze Corporation

Q100: Heron Corporation,a calendar year C corporation,had an

Q101: Schedule M-1 of Form 1120 is used

Q103: A taxpayer is considering the formation of

Q130: In the current year, Crow Corporation, a