Essay

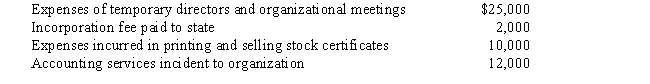

Warbler Corporation,an accrual method regular corporation,was formed and began operations on March 1,2017.The following expenses were incurred during its first year of operations (March 1 - December 31,2017):

a.Assuming a valid election under § 248 to amortize organizational expenditures, what is the amount of Warbler's deduction for 2017?

a., except that Warbler also incurred in 2017 legal fees of $15,000 for the drafting of the corporate charter and bylaws. What is the amount of Warbler's 2017 deduction for organizational expenditures?

b.Same as

Correct Answer:

Verified

Correct Answer:

Verified

Q23: Quail Corporation is a C corporation with

Q38: On December 31,2017,Lavender,Inc.,an accrual basis C corporation,accrues

Q40: Peach Corporation had $210,000 of net active

Q41: Robin Corporation,a calendar year C corporation,had taxable

Q44: Thrush Corporation files Form 1120,which reports taxable

Q46: In each of the following independent situations,determine

Q47: In 2017,Bluebird Corporation had net income from

Q48: Gerald,a cash basis taxpayer,owns 70% of the

Q53: Tomas owns a sole proprietorship, and Lucy

Q69: In the current year, Sunset Corporation (a