Essay

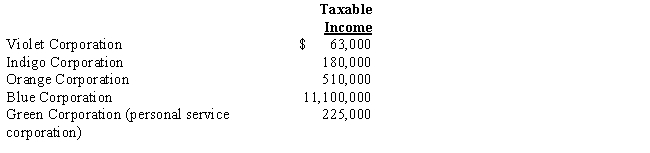

In each of the following independent situations,determine the corporation's income tax liability.Assume that all corporations use a calendar year 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q41: Robin Corporation,a calendar year C corporation,had taxable

Q43: Warbler Corporation,an accrual method regular corporation,was formed

Q44: Thrush Corporation files Form 1120,which reports taxable

Q47: In 2017,Bluebird Corporation had net income from

Q48: Gerald,a cash basis taxpayer,owns 70% of the

Q49: Ed,an individual,incorporates two separate businesses that he

Q50: During the current year,Skylark Company had operating

Q51: Which of the following statements is incorrect

Q53: Tomas owns a sole proprietorship, and Lucy

Q69: In the current year, Sunset Corporation (a