Multiple Choice

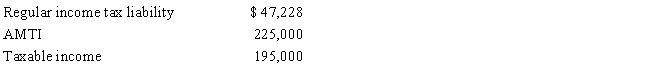

Ashby,who is single and age 30,provides you with the following information from his financial records for 2017.

Calculate his AMT exemption for 2017.

A) $0

B) $26,075

C) $28,225

D) $54,300

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: Which of the following statements describing the

Q22: In the current tax year for regular

Q32: What tax rates apply in calculating the

Q47: Use the following data to calculate Jolene's

Q51: In 2017, Liam's filing status is married

Q55: The phaseout of the AMT exemption amount

Q74: Under what circumstances are C corporations exempt

Q77: Do AMT adjustments and AMT preferences increase

Q80: Which of the following regular taxable income

Q83: Tamara operates a natural gas sole proprietorship