Essay

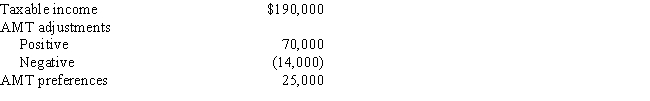

Use the following data to calculate Jolene's AMTI in 2017.Jolene itemizes deductions.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q16: AGI is used as the base for

Q32: What tax rates apply in calculating the

Q42: Ashby,who is single and age 30,provides you

Q50: Prior to the effect of the tax

Q51: In 2017, Liam's filing status is married

Q52: Bianca and David report the following for

Q77: Do AMT adjustments and AMT preferences increase

Q80: Which of the following regular taxable income

Q101: Why is there a need for a

Q106: In deciding to enact the alternative minimum