Multiple Choice

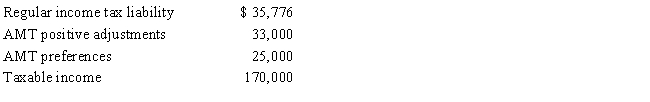

Beulah,who is single,provides you with the following information from her financial records for 2017.Compute Beulah's AMTI.

A) $0

B) $174,050

C) $228,000

D) $232,050

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q13: Are the AMT rates for the individual

Q22: Robin,who is a head of household and

Q25: The corporate AMT does not apply to

Q27: Cher sold undeveloped land that originally cost

Q34: The deduction for personal and dependency exemptions

Q50: The deduction for charitable contributions in calculating

Q62: The AMT exemption for a C corporation

Q82: Prior to the effect of tax credits,

Q85: If the regular income tax deduction for

Q98: In May 2013, Swallow, Inc., issues options