Multiple Choice

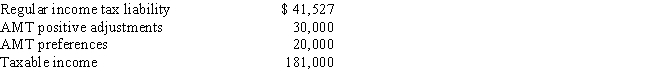

Robin,who is a head of household and age 42,provides you with the following information from his financial records for 2017.Robert itemizes deductions.

Calculate Robin's AMT for 2017.

A) $6,633.

B) $13,332.

C) $48,828.

D) $54,428.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q9: Which of the following statements regarding differences

Q13: Are the AMT rates for the individual

Q25: The corporate AMT does not apply to

Q26: Beulah,who is single,provides you with the following

Q33: Paul incurred circulation expenditures of $180,000 in

Q50: The deduction for charitable contributions in calculating

Q53: Because passive losses are not deductible in

Q62: The AMT exemption for a C corporation

Q75: All of a C corporation's AMT is

Q85: If the regular income tax deduction for