Essay

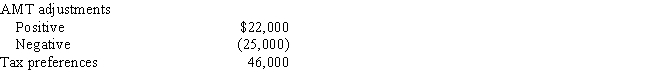

Arlene,who is single,reports taxable income for 2017 of $112,000.Calculate her alternative minimum tax,if any,given the following additional information.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q1: Which of the following statements concerning capital

Q30: For individual taxpayers, the AMT credit is

Q35: If Abby's alternative minimum taxable income exceeds

Q35: Akeem, who does not itemize, incurred a

Q38: Andrea, who is single, is entitled to

Q41: Marvin, the vice president of Lavender, Inc.,

Q83: Assuming no phaseout, the AMT exemption amount

Q97: Caroline and Clint are married,have no dependents,and

Q104: Gunter,who is divorced,reports the following items for

Q109: After personal property is fully depreciated for