Essay

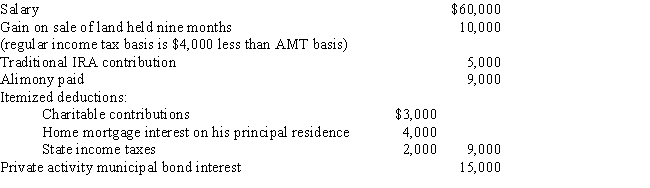

Gunter,who is divorced,reports the following items for 2017.Calculate Gunter's 2017 AMTI.

Correct Answer:

Verified

Gunter's regular income tax ta...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Gunter's regular income tax ta...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q1: Which of the following statements concerning capital

Q14: The required adjustment for AMT purposes for

Q30: A taxpayer has a passive activity loss

Q41: Marvin, the vice president of Lavender, Inc.,

Q83: Assuming no phaseout, the AMT exemption amount

Q84: Income from some long-term contracts can be

Q87: The AMT exemption for a corporation with

Q99: Arlene,who is single,reports taxable income for 2017

Q108: Ted,who is single,owns a personal residence in

Q109: After personal property is fully depreciated for