Essay

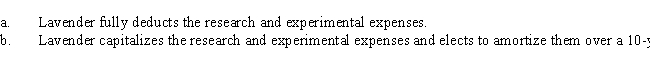

Lavender,Inc.,incurs research and experimental expenditures of $210,000 in 2017.Determine the amount of the AMT adjustment for 2017 and for 2018 if for regular income tax purposes,assuming in independent cases that:

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q14: The required adjustment for AMT purposes for

Q30: A taxpayer has a passive activity loss

Q32: Evan is a contractor who constructs both

Q38: How can an AMT adjustment be avoided

Q77: Beige, Inc., records AMTI of $200,000. Calculate

Q79: Business tax credits reduce the AMT and

Q84: Income from some long-term contracts can be

Q87: The AMT exemption for a corporation with

Q108: Ted,who is single,owns a personal residence in

Q114: In calculating her 2017 taxable income,Rhonda,who is