Essay

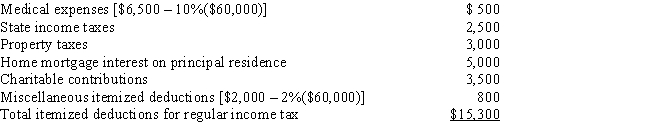

In calculating her 2017 taxable income,Rhonda,who is age 45,claims the following itemized deductions.

Calculate Rhonda's AMT adjustment for itemized deductions.

Correct Answer:

Verified

Rhonda's allowed itemized dedu...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q14: The required adjustment for AMT purposes for

Q32: Evan is a contractor who constructs both

Q32: A taxpayer who expenses circulation expenditures in

Q38: How can an AMT adjustment be avoided

Q65: Tad and Audria, who are married filing

Q66: Frederick sells equipment whose adjusted basis for

Q77: Beige, Inc., records AMTI of $200,000. Calculate

Q79: Business tax credits reduce the AMT and

Q93: Identify an AMT adjustment that applies for

Q110: Lavender,Inc.,incurs research and experimental expenditures of $210,000