Essay

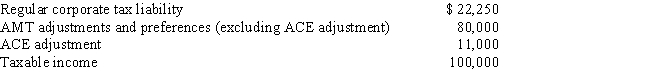

Crimson,Inc.,provides you with the following information.

Calculate Crimson's AMT for 2017.

Correct Answer:

Verified

Crimson's ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

Crimson's ...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Related Questions

Q3: Interest income on private activity bonds issued

Q16: AGI is used as the base for

Q50: Prior to the effect of the tax

Q52: Bianca and David report the following for

Q54: If a taxpayer deducts the standard deduction

Q59: Use the following selected data to calculate

Q69: In 2017, Blake incurs $270,000 of mining

Q94: In the current tax year, Ben exercised

Q98: What itemized deductions are allowed for both

Q101: Why is there a need for a