Multiple Choice

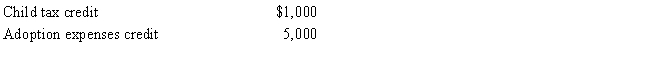

Prior to the effect of the tax credits,Justin's regular income tax liability is $200,000.and his tentative minimum tax is $195,000.Justin reports the following credits.

Calculate Justin's tax liability after credits.

A) $190,000

B) $194,000

C) $195,000

D) $200,000

Correct Answer:

Verified

Correct Answer:

Verified

Q3: Interest income on private activity bonds issued

Q16: AGI is used as the base for

Q32: What tax rates apply in calculating the

Q47: Use the following data to calculate Jolene's

Q51: In 2017, Liam's filing status is married

Q52: Bianca and David report the following for

Q54: Crimson,Inc.,provides you with the following information.<br><br> <img

Q69: In 2017, Blake incurs $270,000 of mining

Q101: Why is there a need for a

Q106: In deciding to enact the alternative minimum