Essay

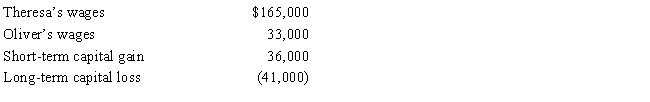

Theresa and Oliver,married filing jointly,and both over 65 years of age,have no dependents.Their 2017 income tax facts are:

What is their taxable income for 2017?

Correct Answer:

Verified

The couple's taxable income is...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: A business taxpayer sells inventory for $80,000.

Q17: Samuel, head of household with two dependents,

Q29: Copper Corporation sold machinery for $47,000 on

Q34: Which of the following is correct concerning

Q42: Involuntary conversion gains may be deferred if

Q43: Orange Company had machinery destroyed by a

Q61: Residential real estate was purchased in 2014

Q76: An individual taxpayer has the gains and

Q160: Section 1239 (relating to the sale of

Q165: Which of the following assets held by