Essay

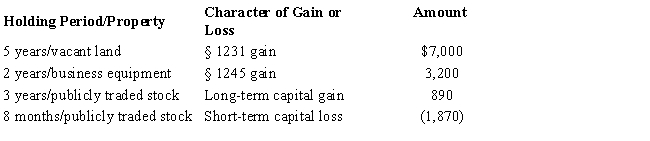

An individual taxpayer has the gains and losses shown below.There are $3,000 of § 1231 lookback losses.What is the net long-term capital gain?

Correct Answer:

Verified

The taxpayer has a net long-term capital...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: A business taxpayer sells inventory for $80,000.

Q14: The holding period of property given up

Q17: Samuel, head of household with two dependents,

Q29: Copper Corporation sold machinery for $47,000 on

Q42: Involuntary conversion gains may be deferred if

Q42: On June 10, 2017, Ebon, Inc. acquired

Q71: Theresa and Oliver,married filing jointly,and both over

Q78: Betty,a single taxpayer with no dependents,has the

Q107: All collectibles short-term gain is subject to

Q152: Individuals who are not professional real estate