Essay

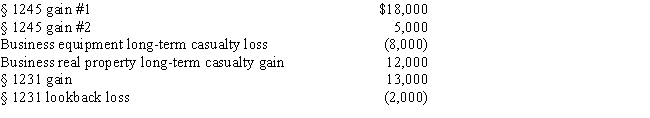

Betty,a single taxpayer with no dependents,has the gains and losses shown below.Before considering these transactions,Betty has $45,000 of other taxable income.What is the treatment of the gains and losses and what is Betty's taxable income?

Correct Answer:

Verified

The § 1245 recapture gains are combined ...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q11: A business taxpayer sells inventory for $80,000.

Q14: The holding period of property given up

Q17: Samuel, head of household with two dependents,

Q32: An individual taxpayer with 2017 net short-term

Q42: On June 10, 2017, Ebon, Inc. acquired

Q42: Involuntary conversion gains may be deferred if

Q76: An individual taxpayer has the gains and

Q83: Seamus had $16,000 of net short-term capital

Q107: All collectibles short-term gain is subject to

Q152: Individuals who are not professional real estate