Essay

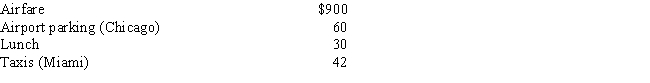

Alfredo,a self-employed patent attorney,flew from his home in Chicago to Miami,had lunch alone at the airport,conducted business in the afternoon,and returned to Chicago in the evening.His expenses were as follows:

What is Alfredo's deductible expense for the trip?

Correct Answer:

Verified

$1,002 ($900 + $60 +...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: Rod uses his automobile for both business

Q27: Which, if any, of the following is

Q34: Ralph made the following business gifts during

Q35: During the year,Walt travels from Seattle to

Q42: Logan, Caden, and Olivia are three unrelated

Q74: The § 222 deduction for tuition and

Q82: After the automatic mileage rate has been

Q97: In some cases it may be appropriate

Q162: Regarding the new simplified method of computing

Q168: Match the statements that relate to each