Essay

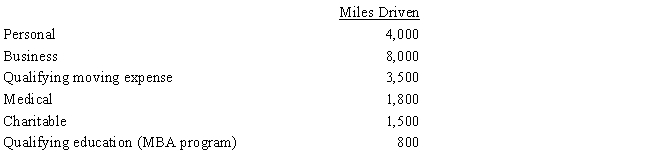

Rod uses his automobile for both business and personal use and claims the automatic mileage rate for all purposes.During 2017,his mileage was as follows:

How much can Rod claim for mileage?

Correct Answer:

Verified

$5,819 [(8,800 miles × $0.535,...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q27: Which, if any, of the following is

Q30: Alfredo,a self-employed patent attorney,flew from his home

Q42: Logan, Caden, and Olivia are three unrelated

Q74: The § 222 deduction for tuition and

Q82: After the automatic mileage rate has been

Q86: If a business retains someone to provide

Q87: Under the simplified method, the maximum office

Q138: When using the automatic mileage method, which,

Q164: A taxpayer who claims the standard deduction

Q168: Match the statements that relate to each