Multiple Choice

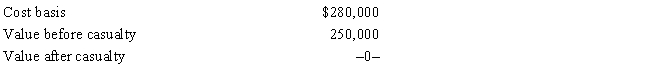

In 2017,Grant's personal residence was completely destroyed by fire.Grant was insured for 100% of his actual loss,and he received the insurance settlement.Grant had adjusted gross income,before considering the casualty item,of $30,000.Pertinent data with respect to the residence follows:

What is Grant's allowable casualty loss deduction?

A) $0

B) $6,500

C) $6,900

D) $10,000

E) $80,000

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The amount of a loss on insured

Q12: A loss is not allowed for a

Q16: Last year, taxpayer had a $10,000 nonbusiness

Q29: Regarding research and experimental expenditures, which of

Q62: A bond held by an investor that

Q63: In 2017,Tan Corporation incurred the following expenditures

Q65: Red Company is a proprietorship owned by

Q95: A loss from a worthless security is

Q100: Taxpayer's home was destroyed by a storm

Q123: Norm's car, which he uses 100% for