Essay

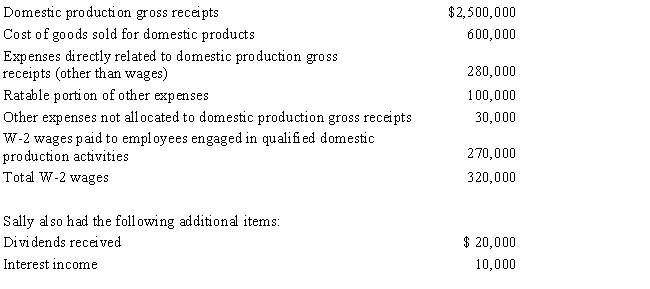

Red Company is a proprietorship owned by Sally,a single individual.Red manufactures and sells widgets.An examination of Red's records shows the following items for the current year:

Determine Sally's domestic production activities deduction for the current year.

Correct Answer:

Verified

Correct Answer:

Verified

Q10: The amount of a loss on insured

Q12: A loss is not allowed for a

Q16: Last year, taxpayer had a $10,000 nonbusiness

Q29: Regarding research and experimental expenditures, which of

Q63: In 2017,Tan Corporation incurred the following expenditures

Q64: In 2017,Grant's personal residence was completely destroyed

Q77: A nonbusiness bad debt deduction can be

Q95: A loss from a worthless security is

Q100: Taxpayer's home was destroyed by a storm

Q123: Norm's car, which he uses 100% for