Multiple Choice

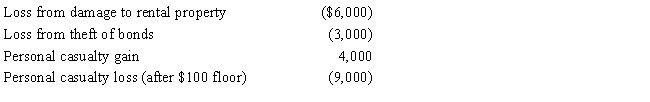

In 2017,Morley,a single taxpayer,had an AGI of $30,000 before considering the following items:

Determine the amount of Morley's itemized deduction from the losses.

A) $0

B) $2,900

C) $5,120

D) $5,600

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: On June 2, 2016, Fred's TV Sales

Q12: In the current year,Juan's home was burglarized.Juan

Q19: Gary,who is an employee of Red Corporation,has

Q39: A cash basis taxpayer must include as

Q41: If qualified production activities income (QPAI) cannot

Q59: Identify the factors that should be considered

Q69: On September 3, 2016, Able, a single

Q70: On February 20, 2016, Bill purchased stock

Q78: On July 20, 2016, Matt (who files

Q80: The current position of the IRS is