Essay

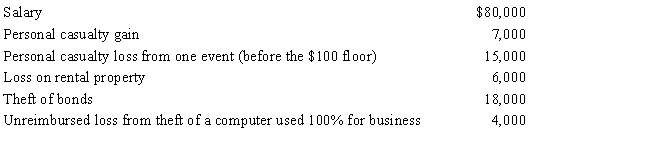

Gary,who is an employee of Red Corporation,has the following items for 2017:

Determine Gary's AGI and total amount of itemized deductions for 2017.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q11: On June 2, 2016, Fred's TV Sales

Q15: In 2017,Morley,a single taxpayer,had an AGI of

Q20: A taxpayer who sustains a casualty loss

Q22: Bruce,who is single,had the following items for

Q23: Losses on rental property are classified as

Q27: Al, who is single, has a gain

Q59: Identify the factors that should be considered

Q70: On February 20, 2016, Bill purchased stock

Q78: On July 20, 2016, Matt (who files

Q80: The current position of the IRS is