Multiple Choice

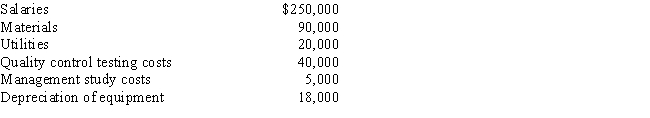

Last year,Green Corporation incurred the following expenditures in the development of a new plant process:

During the current year,benefits from the project began being realized in May.If Green Corporation elects a 60 month deferral and amortization period,determine the amount of the deduction for the current year.

A) $48,000

B) $50,400

C) $54,667

D) $57,067

E) None of the above

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Mary incurred a $20,000 nonbusiness bad debt

Q36: Two years ago, Gina loaned Tom $50,000.

Q84: While Susan was on vacation during the

Q85: In 2017,Theo,an employee,had a salary of $30,000

Q87: An individual may deduct a loss on

Q88: Jose,single,had the following items for 2017:<br><br> <img

Q93: Which of the following events would produce

Q94: Roger, an individual, owns a proprietorship called

Q98: If personal casualty gains exceed personal casualty

Q102: Research and experimental expenditures do not include