Essay

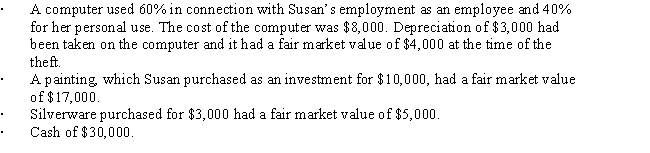

While Susan was on vacation during the current year,someone broke into her home and stole the following items:

Susan's adjusted gross income,before considering any of the above items,is $60,000.

Determine the total amount of Susan's itemized deductions resulting from the theft.

Correct Answer:

Verified

Correct Answer:

Verified

Q35: Mary incurred a $20,000 nonbusiness bad debt

Q36: Two years ago, Gina loaned Tom $50,000.

Q79: Tonya had the following items for last

Q80: Maria,who is single,had the following items for

Q81: Green,Inc.,manufactures and sells widgets.During the current year,an

Q85: In 2017,Theo,an employee,had a salary of $30,000

Q87: An individual may deduct a loss on

Q87: Last year,Green Corporation incurred the following expenditures

Q88: Jose,single,had the following items for 2017:<br><br> <img

Q102: Research and experimental expenditures do not include