Multiple Choice

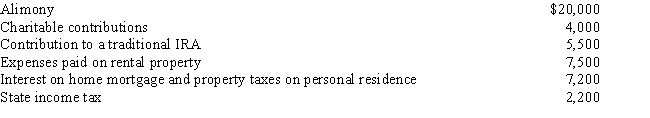

Al is single,age 60,and has gross income of $140,000.His deductible expenses are as follows:

What is Al's AGI?

A) $94,100.

B) $103,000.

C) $107,000.

D) $127,000.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q26: While she was a college student, Angel

Q42: Kitty runs a brothel (illegal under state

Q47: Tom operates an illegal drug-running operation and

Q50: Rex,a cash basis calendar year taxpayer,runs a

Q51: Priscella pursued a hobby of making bedspreads

Q78: Generally, a closely held family corporation is

Q121: Max opened his dental practice (a sole

Q125: Which of the following are deductions for

Q144: A vacation home at the beach which

Q147: Taylor, a cash basis architect, rents the