Essay

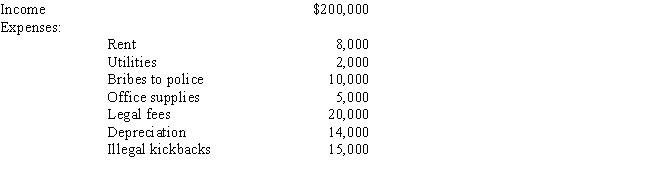

Kitty runs a brothel (illegal under state law) and has the following items of income and expense.What is the amount that she must include in taxable income from her operation?

Correct Answer:

Verified

The bribes to po...

The bribes to po...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q26: While she was a college student, Angel

Q46: Al is single,age 60,and has gross income

Q47: Tom operates an illegal drug-running operation and

Q48: Payments by a cash basis taxpayer of

Q78: Generally, a closely held family corporation is

Q80: Which of the following statements is correct

Q87: Under what circumstances may a taxpayer deduct

Q99: Paula is the sole shareholder of Violet,

Q144: A vacation home at the beach which

Q147: Taylor, a cash basis architect, rents the