Multiple Choice

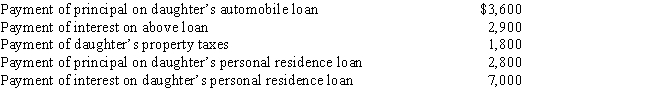

Melba incurred the following expenses for her dependent daughter during the current year:

How much may Melba deduct in computing her itemized deductions?

A) $0.

B) $8,800.

C) $11,700.

D) $18,100.

E) None of the above.

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q7: If a vacation home is classified as

Q12: If a taxpayer operated an illegal business

Q18: Albie operates an illegal drug-running business and

Q19: Marvin spends the following amounts on a

Q49: Which of the following is not relevant

Q58: Susan is a sales representative for a

Q66: The legal cost of having a will

Q89: In order to protect against rent increases

Q93: Legal expenses incurred in connection with rental

Q137: Bridgett's son, Clyde, is $12,000 in arrears