Essay

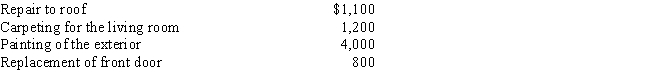

Marvin spends the following amounts on a house he owns:

a.How much of these expenses can Marvin deduct if the house is his principal residence?

b.How much of these expenses can Marvin deduct if he rents the house to a tenant?

c.Classify any deductible expenses as deductions for AGI or as deductions from AGI.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: Salaries are considered an ordinary and necessary

Q12: If a taxpayer operated an illegal business

Q18: Albie operates an illegal drug-running business and

Q21: Melba incurred the following expenses for her

Q49: Which of the following is not relevant

Q66: The legal cost of having a will

Q89: In order to protect against rent increases

Q93: Legal expenses incurred in connection with rental

Q137: Bridgett's son, Clyde, is $12,000 in arrears

Q153: Tommy, an automobile mechanic employed by an