Multiple Choice

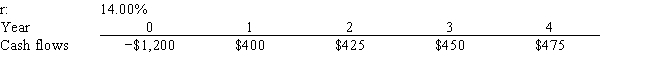

Yoga Center Inc. is considering a project that has the following cash flow and cost of capital (r) data. What is the project's NPV? Note that a project's expected NPV can be negative, in which case it will be rejected.

A) $41.25

B) $45.84

C) $50.93

D) $56.59

E) $62.88

Correct Answer:

Verified

Correct Answer:

Verified

Q14: A project's IRR is independent of the

Q17: Markman & Sons is considering Projects S

Q18: Computer Consultants Inc. is considering a project

Q20: Projects S and L are equally risky,

Q21: Craig's Car Wash Inc. is considering a

Q23: Pet World is considering a project that

Q26: Current Design Co. is considering two mutually

Q27: Carolina Company is considering Projects S and

Q42: Assuming that their NPVs based on the

Q50: Which of the following statements is NOT