Multiple Choice

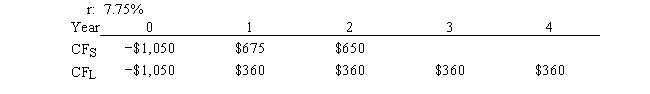

Carolina Company is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and are not repeatable. If the decision is made by choosing the project with the higher IRR, how much value will be forgone? Note that under some conditions choosing projects on the basis of the IRR will cause $0.00 value to be lost.

A) $11.45

B) $12.72

C) $14.63

D) $16.82

E) $19.35

Correct Answer:

Verified

Correct Answer:

Verified

Q14: A project's IRR is independent of the

Q20: Projects S and L are equally risky,

Q22: Yoga Center Inc. is considering a project

Q23: Pet World is considering a project that

Q26: Current Design Co. is considering two mutually

Q28: Modern Refurbishing Inc. is considering a project

Q29: Robbins Inc. is considering a project that

Q32: Watts Co. is considering a project that

Q36: The cost of capital for two mutually

Q59: Project S has a pattern of high