REFERENCE: Ref.09_03 Car Corp.(a U.S.-Based Company)sold Parts to a Korean Customer on Customer

Multiple Choice

REFERENCE: Ref.09_03

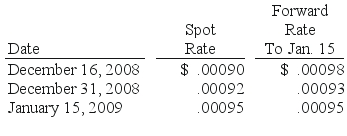

Car Corp.(a U.S.-based company) sold parts to a Korean customer on December 16,2008,with payment of 10 million Korean won to be received on January 15,2009.The following exchange rates applied:

SHAPE \* MERGEFORMAT

-Assuming a forward contract was entered into,what would be the net impact on Car Corp.'s 2008 income statement related to this transaction? Assume an annual interest rate of 12% and a fair value hedge.The present value for one month at 12% is .9901.

A) $ 700 (gain) .

B) $ 700 (loss) .

C) $ 300 (gain) .

D) $ 300 (loss) .

E) $ 295.05 (loss) .

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Where can you find exchange rates between

Q23: What happens when a U.S. company purchases

Q26: A U.S. company sells merchandise to a

Q55: REFERENCE: Ref.09_10<br>On October 1,2007,Eagle Company forecasts the

Q58: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q59: Pigskin Co. ,a U.S.corporation,sold inventory on credit

Q60: What is meant by the spot rate?

Q60: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q67: Williams, Inc., a U.S. company, has a

Q86: Larson Company, a U.S. company, has an