REFERENCE: Ref.09_07 Winston Corp. ,A U.S.company,had the Following Foreign Currency Transactions During

Multiple Choice

REFERENCE: Ref.09_07

Winston Corp. ,a U.S.company,had the following foreign currency transactions during 2008:

(1. ) Purchased merchandise from a foreign supplier on July 16,2008 for the U.S.dollar equivalent of $47,000 and paid the invoice on August 3,2008 at the U.S.dollar equivalent of $54,000.

(2. ) On October 15,2008 borrowed the U.S.dollar equivalent of $315,000 evidenced by a non-interest-bearing note payable in euros on October 15,2008.The U.S.dollar equivalent of the note amount was $295,000 on December 31,2008,and $299,000 on October 15,2009.

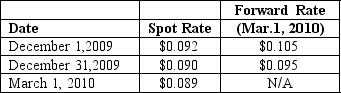

-On December 1,2009,Joseph Company,a U.S.company,entered into a three-month forward contract to purchase 50,000 pesos on March 1,2010.The following U.S.dollar per peso exchange rates apply:

Joseph's incremental borrowing rate is 12 percent.The present value factor for two months at an annual interest rate of 12 percent is .9803.Which of the following is included in Joseph's December 31,2009 balance sheet for the forward contract?

A) $5,146.58 asset.

B) $5,146.58 liability.

C) $500 liability.

D) $490.15 asset.

E) $490.15 liability.

Correct Answer:

Verified

Correct Answer:

Verified

Q13: Where can you find exchange rates between

Q23: What happens when a U.S. company purchases

Q23: What amount of foreign exchange gain or

Q55: REFERENCE: Ref.09_10<br>On October 1,2007,Eagle Company forecasts the

Q57: REFERENCE: Ref.09_03<br>Car Corp.(a U.S.-based company)sold parts to

Q59: Pigskin Co. ,a U.S.corporation,sold inventory on credit

Q60: What is meant by the spot rate?

Q60: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q67: Williams, Inc., a U.S. company, has a

Q86: Larson Company, a U.S. company, has an