REFERENCE: Ref.09_10 on October 1,2007,Eagle Company Forecasts the Purchase of Inventory from Inventory

Multiple Choice

REFERENCE: Ref.09_10

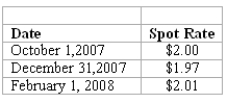

On October 1,2007,Eagle Company forecasts the purchase of inventory from a British supplier on February 1,2008,at a price of 100,000 British pounds.On October 1,2007,Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound.The option is considered to be a cash flow hedge of a forecasted foreign currency transaction.On December 31,2007,the option has a fair value of $1,600.The following spot exchange rates apply:

-What is the amount of Cost of Goods Sold for 2008 as a result of these transactions?

A) $200,000.

B) $195,000.

C) $201,000.

D) $202,600.

E) $203,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q8: REFERENCE: Ref.09_03<br>Car Corp.(a U.S.-based company)sold parts to

Q9: REFERENCE: Ref.09_05<br>On April 1,2007,Shannon Company,a U.S.company,borrowed 100,000

Q11: REFERENCE: Ref.09_03<br>Car Corp.(a U.S.-based company)sold parts to

Q15: A spot rate may be defined as<br>A)

Q16: REFERENCE: Ref.09_06<br>Parker Corp. ,a U.S.company,had the following

Q17: REFERENCE: Ref.09_12<br>On November 10,2008,King Co.sold inventory to

Q18: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q53: What happens when a U.S. company purchases

Q80: What happens when a U.S. company sells

Q93: Assuming this is a fair value hedge;