REFERENCE: Ref.09_12 on November 10,2008,King Co.sold Inventory to a Customer in a in a Foreign

Essay

REFERENCE: Ref.09_12

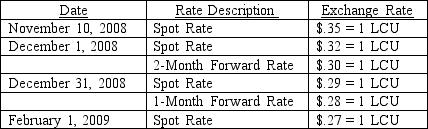

On November 10,2008,King Co.sold inventory to a customer in a foreign country.King agreed to accept 96,000 local currency units (LCU)in full payment for this inventory.Payment was to be made on February 1,2009.On December 1,2008,King entered into a forward exchange contract wherein 96,000 LCU would be delivered to a currency broker in two months.The two month forward exchange rate on that date was 1 LCU = $.30.The spot rates and forward rates on various dates were as follows:

The company's borrowing rate is 12%.The present value factor for one month is .9901.

The company's borrowing rate is 12%.The present value factor for one month is .9901.

-(A. )Assume this hedge is designated as a cash flow hedge.Prepare the journal entries relating to the transaction and the forward contract.

(B. )Compute the effect on 2008 net income.

(C. )Compute the effect on 2009 net income.

Correct Answer:

Verified

1 [(.30 - .28)96,00...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

1 [(.30 - .28)96,00...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q12: For what amount should Brisco's Accounts Payable

Q13: REFERENCE: Ref.09_10<br>On October 1,2007,Eagle Company forecasts the

Q16: REFERENCE: Ref.09_06<br>Parker Corp. ,a U.S.company,had the following

Q18: REFERENCE: Ref.09_07<br>Winston Corp. ,a U.S.company,had the following

Q19: REFERENCE: Ref.09_08<br>On May 1,2007,Mosby Company received an

Q20: Gaw Produce Co.purchased inventory from a Japanese

Q53: What happens when a U.S. company purchases

Q80: What happens when a U.S. company sells

Q93: Assuming this is a fair value hedge;

Q103: What happens when a U.S. company sells