Essay

REFERENCE: Ref.05_13

Several years ago Polar Inc.purchased an 80% interest in Icecap Co.The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values.Polar paid an amount corresponding to the underlying book value of Icecap so that no allocations or goodwill resulted from the purchase price.

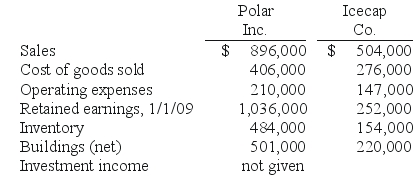

The following selected account balances were from the individual financial records of these two companies as of December 31,2009:

SHAPE \* MERGEFORMAT

-Assume that Polar sold inventory to Icecap at a markup equal to 40% of cost.Intercompany transfers were $126,000 in 2008 and $154,000 in 2009.Of this inventory,$39,200 of the 2008 transfers were retained and then sold by Icecap in 2009 while $58,800 of the 2009 transfers were held until 2010.

Required:

On the consolidated financial statements for 2009,determine the balances that would appear for the following accounts: (1)Cost of Goods Sold, (2)Inventory,and (3)Noncontrolling Interest in Subsidiary's Net Income.(If you use a gross profit percentage,do not round the calculation. )

Correct Answer:

Verified

Correct Answer:

Verified

Q38: REFERENCE: Ref.05_13<br>Several years ago Polar Inc.purchased an

Q39: REFERENCE: Ref.05_05<br>Gargiulo Company,a 90% owned subsidiary of

Q40: King Corp.owns 85% of James Co.King uses

Q41: REFERENCE: Ref.05_02<br>On January 1,2009,Pride,Inc.bought 80% of the

Q42: REFERENCE: Ref.05_04<br>Walsh Company sells inventory to its

Q44: Flintstone Inc.acquired all of Rubble Co.on January

Q45: REFERENCE: Ref.05_05<br>Gargiulo Company,a 90% owned subsidiary of

Q46: How is the gain on an intercompany

Q47: REFERENCE: Ref.05_10<br>Stark Company,a 90% owned subsidiary of

Q48: REFERENCE: Ref.05_04<br>Walsh Company sells inventory to its