Essay

REFERENCE: Ref.05_13

Several years ago Polar Inc.purchased an 80% interest in Icecap Co.The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values.Polar paid an amount corresponding to the underlying book value of Icecap so that no allocations or goodwill resulted from the purchase price.

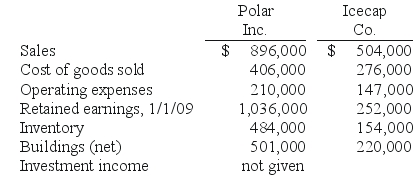

The following selected account balances were from the individual financial records of these two companies as of December 31,2009:

SHAPE \* MERGEFORMAT

-Polar sold a building to Icecap on January 1,2008 for $112,000,although the book value of this asset was only $70,000 on that date.The building had a five-year remaining useful life and was to be depreciated using the straight-line method with no salvage value.

Required:

On the consolidated financial statements for 2009,determine the balances that would appear for the following accounts: (1)Buildings (net), (2)Operating expenses,and (3)Noncontrolling Interest in Subsidiary's Net Income.

Correct Answer:

Verified

Correct Answer:

Verified

Q33: REFERENCE: Ref.05_11<br>Pepe,Incorporated acquired 60% of Devin Company

Q34: Justings Co.owned 80% of Evana Corp.During 2009,Justings

Q35: REFERENCE: Ref.05_14<br>On January 1,2009,Musial Corp.sold equipment to

Q36: REFERENCE: Ref.05_12<br>Virginia Corp.owned all of the voting

Q37: REFERENCE: Ref.05_07<br>On April 1,2009 Wilson Company,a 90%

Q39: REFERENCE: Ref.05_05<br>Gargiulo Company,a 90% owned subsidiary of

Q40: King Corp.owns 85% of James Co.King uses

Q41: REFERENCE: Ref.05_02<br>On January 1,2009,Pride,Inc.bought 80% of the

Q42: REFERENCE: Ref.05_04<br>Walsh Company sells inventory to its

Q43: REFERENCE: Ref.05_13<br>Several years ago Polar Inc.purchased an