Multiple Choice

REFERENCE: Ref.03_07

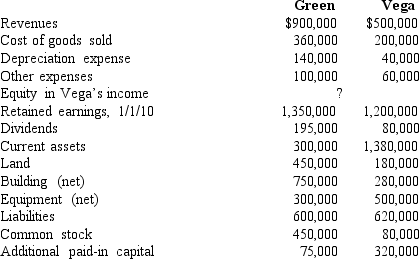

Following are selected accounts for Green Corporation and Vega Company as of December 31,2010.Several of Green's accounts have been omitted.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

Green obtained 100% of Vega on January 1,2006,by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share.On January 1,2006,Vega's land was undervalued by $40,000,its buildings were overvalued by $30,000,and equipment was undervalued by $80,000.The buildings have a 20-year life and the equipment has a 10-year life.$50,000 was attributed to an unrecorded trademark with a 16-year remaining life.There was no goodwill associated with this investment.

-Compute the December 31,2010,consolidated buildings.

A) $1,037,500.

B) $1,007,500.

C) $1,000,000.

D) $1,022,500.

E) $1,012,500.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: REFERENCE: Ref.03_01<br>On January 1,2009,Cale Corp.paid $1,020,000 to

Q6: REFERENCE: Ref.03_16<br>Pritchett Company recently acquired three businesses,recognizing

Q8: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q9: REFERENCE: Ref.03_10<br>Beatty,Inc.acquires 100% of the voting stock

Q10: How much difference would there have been

Q10: Yules Co. acquired Noel Co. in an

Q10: Consolidations subsequent to the date of combination

Q11: REFERENCE: Ref.03_08<br>Goehler,Inc.acquires all of the voting stock

Q35: For an acquisition when the subsidiary retains

Q57: Push-down accounting is concerned with the<br>A) impact