REFERENCE: Ref.03_01 On January 1,2009,Cale Corp.paid $1,020,000 to Acquire Kaltop Co.Kaltop Maintained

Multiple Choice

REFERENCE: Ref.03_01

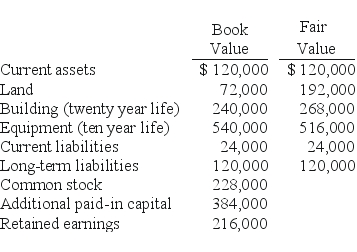

On January 1,2009,Cale Corp.paid $1,020,000 to acquire Kaltop Co.Kaltop maintained separate incorporation.Cale used the equity method to account for the investment.The following information is available for Kaltop's assets,liabilities,and stockholders' equity accounts:

SHAPE \* MERGEFORMAT

Kaltop earned net income for 2009 of $126,000 and paid dividends of $48,000 during the year.

Kaltop earned net income for 2009 of $126,000 and paid dividends of $48,000 during the year.

-The 2009 total amortization of allocations is calculated to be

A) $4,000.

B) $6,400.

C) $(2,400) .

D) $(1,000) .

E) $3,800.

Correct Answer:

Verified

Correct Answer:

Verified

Q2: REFERENCE: Ref.03_07<br>Following are selected accounts for Green

Q6: REFERENCE: Ref.03_16<br>Pritchett Company recently acquired three businesses,recognizing

Q8: REFERENCE: Ref.03_05<br>Perry Company obtains 100% of the

Q9: REFERENCE: Ref.03_10<br>Beatty,Inc.acquires 100% of the voting stock

Q10: How much difference would there have been

Q10: Yules Co. acquired Noel Co. in an

Q10: Consolidations subsequent to the date of combination

Q11: REFERENCE: Ref.03_08<br>Goehler,Inc.acquires all of the voting stock

Q35: For an acquisition when the subsidiary retains

Q57: Push-down accounting is concerned with the<br>A) impact