Essay

REFERENCE: Ref.03_14

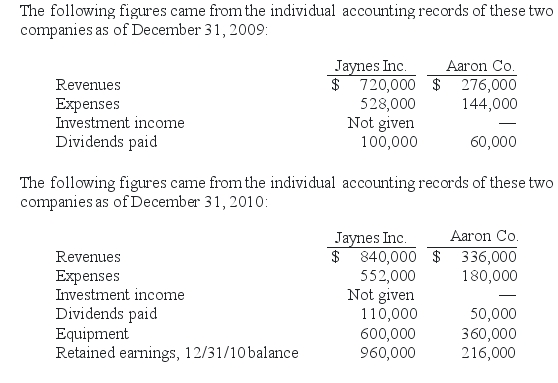

Jaynes Inc.obtained all of Aaron Co.'s common stock on January 1,2009,by issuing 11,000 shares of $1 par value common stock.Jaynes' shares had a $17 per share fair value.On that date,Aaron reported a net book value of $120,000.However,its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records.Any excess of consideration transferred over fair value of assets and liabilities is assigned to an unrecorded patent to be amortized over ten years.

SHAPE \* MERGEFORMAT

-If this combination is viewed as an acquisition,what was consolidated equipment as of December 31,2010?

Correct Answer:

Verified

Correct Answer:

Verified

Q50: From which methods can a parent choose

Q69: All of the following are acceptable methods

Q97: When is a goodwill impairment loss recognized?<br>A)

Q97: Kaye Company acquired 100% of Fiore Company

Q105: What advantages might push-down accounting offer for

Q107: REFERENCE: Ref.03_06<br>Kaye Company acquired 100% of Fiore

Q110: REFERENCE: Ref.03_12<br>Watkins,Inc.acquires all of the outstanding stock

Q110: Kaye Company acquired 100% of Fiore Company

Q116: REFERENCE: Ref.03_15<br>Utah Inc.obtained all of the outstanding

Q117: On January 1,2009,Jumper Co.acquired all of the