Essay

REFERENCE: Ref.03_15

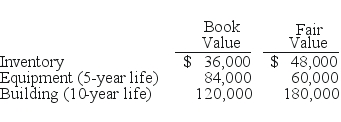

Utah Inc.obtained all of the outstanding common stock of Trimmer Corp.on January 1,2009.At that date,Trimmer owned only three assets and had no liabilities:

SHAPE \* MERGEFORMAT

-If Utah paid $264,000 in cash for Trimmer,and the original transaction occurred on January 1,2008 under SFAS 141,what allocation should have been assigned to the subsidiary's Building account and its Equipment account in a December 31,2010 consolidation? The fair value of net assets is $288,000.

Correct Answer:

Verified

Since Utah paid $24,000 less than the $2...View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q50: From which methods can a parent choose

Q69: All of the following are acceptable methods

Q97: Kaye Company acquired 100% of Fiore Company

Q105: What advantages might push-down accounting offer for

Q112: REFERENCE: Ref.03_14<br>Jaynes Inc.obtained all of Aaron Co.'s

Q117: On January 1,2009,Jumper Co.acquired all of the

Q118: REFERENCE: Ref.03_08<br>Goehler,Inc.acquires all of the voting stock

Q119: REFERENCE: Ref.03_01<br>On January 1,2009,Cale Corp.paid $1,020,000 to

Q120: REFERENCE: Ref.03_06<br>Kaye Company acquired 100% of Fiore

Q121: REFERENCE: Ref.03_14<br>Jaynes Inc.obtained all of Aaron Co.'s