REFERENCE: Ref.02_01 Bullen Inc.assumed 100% Control Over Vicker Inc.on January 1,20X1.The Book

Multiple Choice

REFERENCE: Ref.02_01

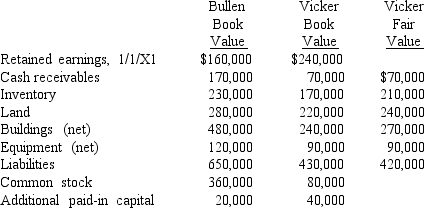

Bullen Inc.assumed 100% control over Vicker Inc.on January 1,20X1.The book value and fair value of Vicker's accounts on that date (prior to creating the combination) follow,along with the book value of Bullen's accounts:

-Assume that Bullen issued 12,000 shares of common stock with a $5 par value and a $42 fair value for all of the outstanding shares of Vicker.What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1,20X1 balances) as a result of this transaction (which is not a pooling of interests) ?

A) $20,000 and $160,000.

B) $20,000 and $260,000.

C) $380,000 and $160,000.

D) $464,000 and $160,000.

E) $380,000 and $260,000.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In a pooling of interests,<br>A)revenues and expenses

Q2: REFERENCE: Ref.02_01<br>Bullen Inc.assumed 100% control over Vicker

Q3: REFERENCE: Ref.02_04<br>On January 1,20X1,the Moody company entered

Q4: REFERENCE: Ref.02_06<br>The financial balances for the Atwood

Q6: REFERENCE: Ref.02_05<br>Carnes has the following account balances

Q7: REFERENCE: Ref.02_04<br>On January 1,20X1,the Moody company entered

Q8: REFERENCE: Ref.02_04<br>On January 1,20X1,the Moody company entered

Q10: REFERENCE: Ref.02_03<br>The financial statements for Goodwin,Inc. ,and

Q11: REFERENCE: Ref.02_06<br>The financial balances for the Atwood

Q25: Figure:<br>Presented below are the financial balances for