Multiple Choice

REFERENCE: Ref.02_05

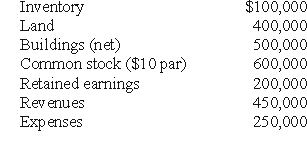

Carnes has the following account balances as of May 1,2000 before a pooling of interests transaction takes place.  The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On May 1,2000,Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock.

The fair value of Carnes' Land and Buildings are $650,000 and $550,000,respectively.On May 1,2000,Riley Company issues 30,000 shares of its $10 par value ($25 fair value) common stock in exchange for all of the shares of Carnes' common stock.

-Assume Riley issues 70,000 shares instead of 30,000 at date of acquisition.Riley currently has $40,000 of additional paid-in capital on its books.By how much will Riley's retained earnings increase or decrease as a result of the combination?

A) $40,000 increase.

B) $200,000 increase.

C) $140,000 increase.

D) $160,000 increase.

E) $40,000 decrease.

Correct Answer:

Verified

Correct Answer:

Verified

Q1: In a pooling of interests,<br>A)revenues and expenses

Q2: REFERENCE: Ref.02_01<br>Bullen Inc.assumed 100% control over Vicker

Q3: REFERENCE: Ref.02_04<br>On January 1,20X1,the Moody company entered

Q4: REFERENCE: Ref.02_06<br>The financial balances for the Atwood

Q5: REFERENCE: Ref.02_01<br>Bullen Inc.assumed 100% control over Vicker

Q7: REFERENCE: Ref.02_04<br>On January 1,20X1,the Moody company entered

Q8: REFERENCE: Ref.02_04<br>On January 1,20X1,the Moody company entered

Q10: REFERENCE: Ref.02_03<br>The financial statements for Goodwin,Inc. ,and

Q11: REFERENCE: Ref.02_06<br>The financial balances for the Atwood

Q25: Figure:<br>Presented below are the financial balances for