Multiple Choice

Figure 4-17

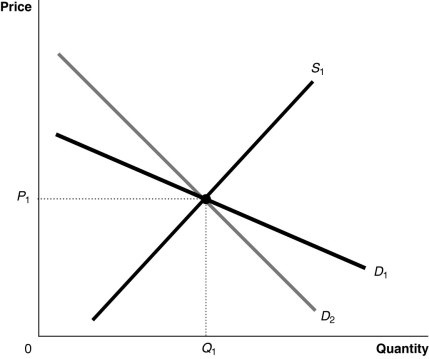

-Refer to Figure 4-17.Suppose the market is initially in equilibrium at price P1 and then the government imposes a tax on every unit sold.Which of the following statements best describes the impact of the tax?

A) The consumer will bear a smaller share of the tax burden if the demand curve is D1.

B) The consumer's share of the tax burden is the same whether the demand curve is D1 or D2.

C) The consumer will bear a smaller share of the tax burden if the demand curve is D2.

D) The consumer will bear the entire burden of the tax if the demand curve is D2 and the producer will bear the entire burden of the tax if the demand curve is D1.

Correct Answer:

Verified

Correct Answer:

Verified

Q7: David Card and Alan Krueger conducted a

Q8: Figure 4-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-1

Q15: For most goods and services,the burden of

Q36: What is the difference between scarcity and

Q39: Employers withhold several taxes from employees '

Q90: The area _ the market supply curve

Q99: Figure 4-1<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 4-1

Q123: Producer surplus is the difference between the

Q195: There will be no deadweight loss if

Q373: Table 4-11<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7397/.jpg" alt="Table 4-11