Multiple Choice

Table 18-9

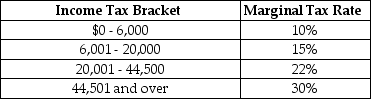

Table 18-9 shows the income tax brackets and tax rates for single taxpayers in Monrovia.

-Refer to Table 18-9.Calculate the income tax paid by Sylvia, a single taxpayer with an income of $70,000.

A) $21,000

B) $15,740

C) $15,400

D) $13,475

Correct Answer:

Verified

Correct Answer:

Verified

Q30: Rapid economic growth tends to increase the

Q79: Figure 18-3<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4192/.jpg" alt="Figure 18-3

Q99: Figure 18-5<br> <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB4193/.jpg" alt="Figure 18-5

Q117: If, as your taxable income decreases, you

Q156: The idea that two taxpayers in the

Q186: The median voter theorem states that the

Q200: Measures of poverty (for example, the poverty

Q230: A marginal tax rate is<br>A)the fraction of

Q242: In the United States, the largest source

Q251: A regressive tax is a tax for