Essay

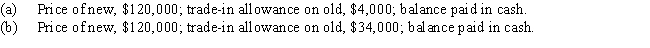

Machinery acquired at a cost of $80,000 and on which there is accumulated depreciation of $55,000 (including depreciation for the current year to date)is exchanged for similar machinery.Assume that the transaction has commercial substance.For financial reporting purposes,present entries to record the exchange of the machinery under each of the following assumptions:

Correct Answer:

Verified

Correct Answer:

Verified

Q8: Equipment acquired at a cost of $126,000

Q48: A fixed asset with a cost of

Q67: When exchanging equipment, if the trade-in allowance

Q84: Which of the following below is an

Q138: A copy machine acquired on July 1

Q150: Computer equipment was acquired at the beginning

Q165: A fixed asset with a cost of

Q180: Though a piece of equipment is still

Q203: The method used to calculate the depletion

Q223: When a company exchanges machinery and receives