Essay

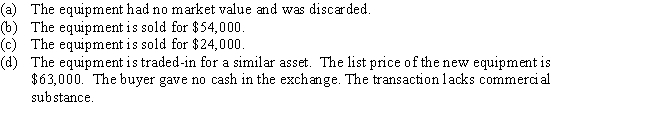

Equipment acquired at a cost of $126,000 has a book value of $42,000.Journalize the disposal of the equipment under the following independent assumptions.

Journal

Journal

Correct Answer:

Verified

Correct Answer:

Verified

Related Questions

Q3: Machinery acquired at a cost of $80,000

Q67: When exchanging equipment, if the trade-in allowance

Q79: When selling a piece of equipment for

Q84: Which of the following below is an

Q138: A copy machine acquired on July 1

Q146: Patents are exclusive rights to produce and

Q150: Computer equipment was acquired at the beginning

Q180: Though a piece of equipment is still

Q203: The method used to calculate the depletion

Q223: When a company exchanges machinery and receives