Multiple Choice

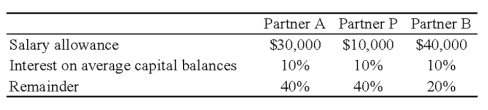

The APB partnership agreement specifies that partnership net income be allocated as follows:

Average capital balances for the current year were $50,000 for A,$30,000 for P,and $20,000 for B.

-Refer to the information given.Assuming a current year net income of $50,000,what amount should be allocated to each partner?

A) Option A

B) Option B

C) Option C

D) Option D

Correct Answer:

Verified

Correct Answer:

Verified

Q10: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the

Q13: In the JAW partnership,Jane's capital is $100,000,Anne's

Q27: In the AD partnership,Allen's capital is $140,000

Q33: The ABC partnership had net income of

Q40: RD formed a partnership on February 10,20X9.R

Q42: The PQ partnership has the following plan

Q46: In the RST partnership,Ron's capital is $80,000,Stella's

Q57: When a new partner is admitted into

Q61: In the ABC partnership (to which Daniel

Q62: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB6499/.jpg" alt=" -Refer to the